The global glass machinery market is demonstrating robust growth, propelled by technological advancements and expanding applications in construction and automotive industries. Key segments like float glass equipment and cleaning systems are evolving with smarter, more efficient solutions, reshaping the competitive landscape.

Market Size and Projections

The float glass machinery sector, valued at $4.01 billion in 2024, is projected to reach $7.18 billion by 2034, growing at a CAGR of 5.4% from 2025 to 2034. Meanwhile, the glass cleaning machine segment saw a 9.1% year-on-year revenue increase in 2024, fueled by ultrasonic technology and intelligent operating systems.

Key Growth Drivers

1. Digitalization and Automation:

Integrated real-time monitoring and AI-driven systems are optimizing production efficiency. For instance, digitalized float glass manufacturing enables predictive maintenance and automated quality checks, reducing human intervention. Innovations like dynamic temperature control and adaptive cutting algorithms further enhance precision.

2. Expanding Demand in Developing Regions:

Rapid urbanization in Asia-Pacific (especially China and India), Latin America, and Africa is accelerating infrastructure projects and automotive production, boosting demand for float glass and energy-efficient glass machinery.

3. Sustainability Requirements:

Strict carbon emission regulations worldwide are pushing manufacturers to adopt machinery for low-emission glass production. For example, advanced coating equipment for energy-saving glass now aligns with green building standards.

Regional Insights

- Asia-Pacific: Dominated the float glass machinery market in 2024, driven by large-scale infrastructure developments and a thriving automotive sector.

- Europe: Focused on high-end, eco-friendly innovations, with emphasis on retrofitting projects and commercial glazing solutions that meet stringent energy efficiency norms.

Technological Trends and Applications

- Construction and Automotive Sectors:

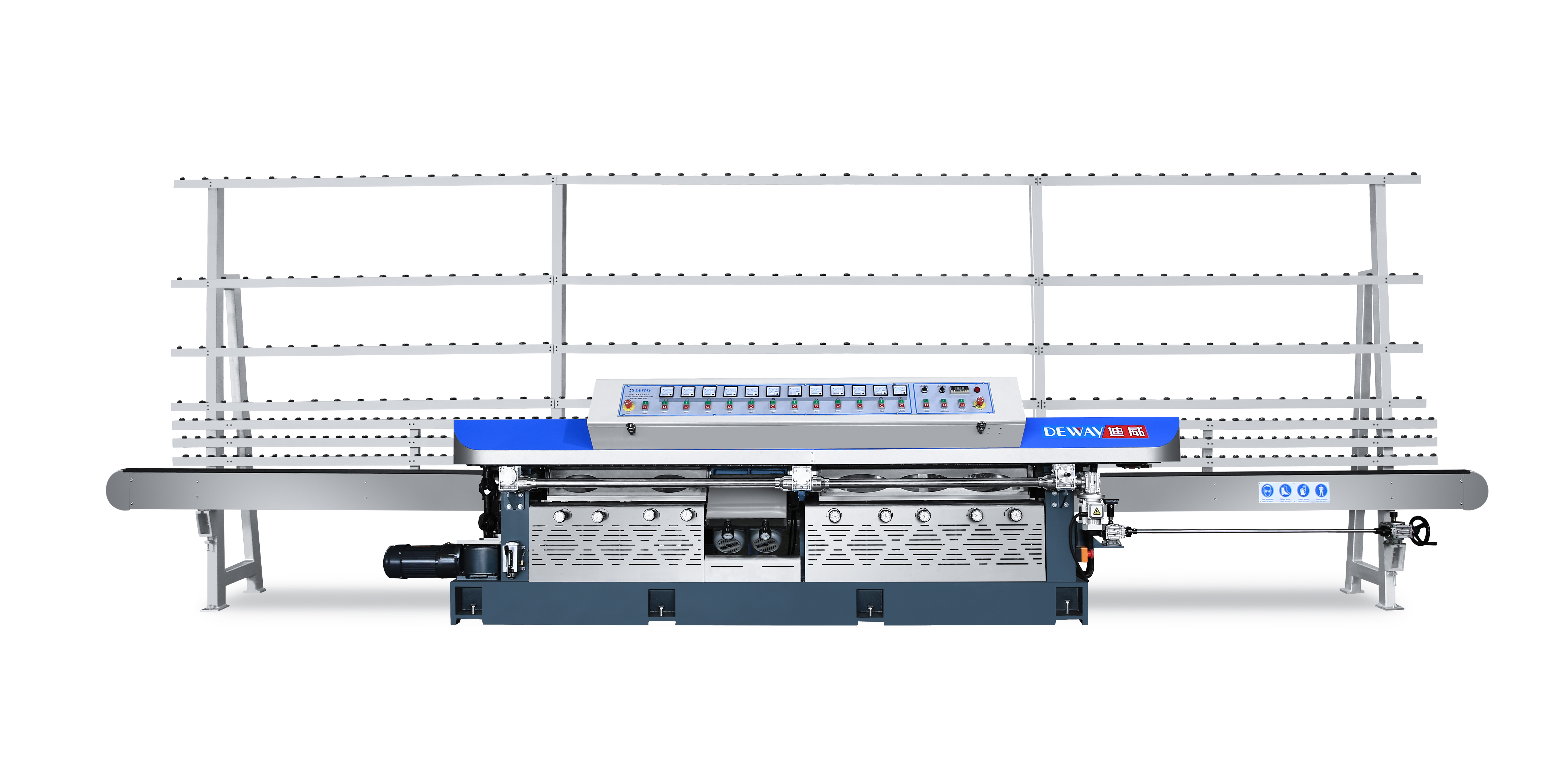

Rising adoption of tempered, laminated, and coated glass in curtain walls and vehicle windows is accelerating upgrades in glass edge polishing machines, double edger machines, and glass washing machines. Companies like Deway Intelligent Equipment Manufacturing Co., Ltd. are addressing these needs with automated lines for edging, cutting, and cleaning, ensuring high precision for complex architectural and automotive glass.

- Intelligent Cleaning Systems:

Ultrasonic glass cleaners, such as those incorporating multi-stage filtration and IoT-based diagnostics, are minimizing manual operations while achieving 99.8% removal of micro-dust particles.

Challenges and Constraints

- Cost Pressures: High production expenses for smart glass products and volatile prices of raw materials (e.g., soda ash) continue to hinder market expansion.

- Intensifying Competition: European and U.S. players lead in high-tech segments, while local manufacturers in emerging economies strive to overcome technical barriers.

Competitive Landscape and Innovation Focus

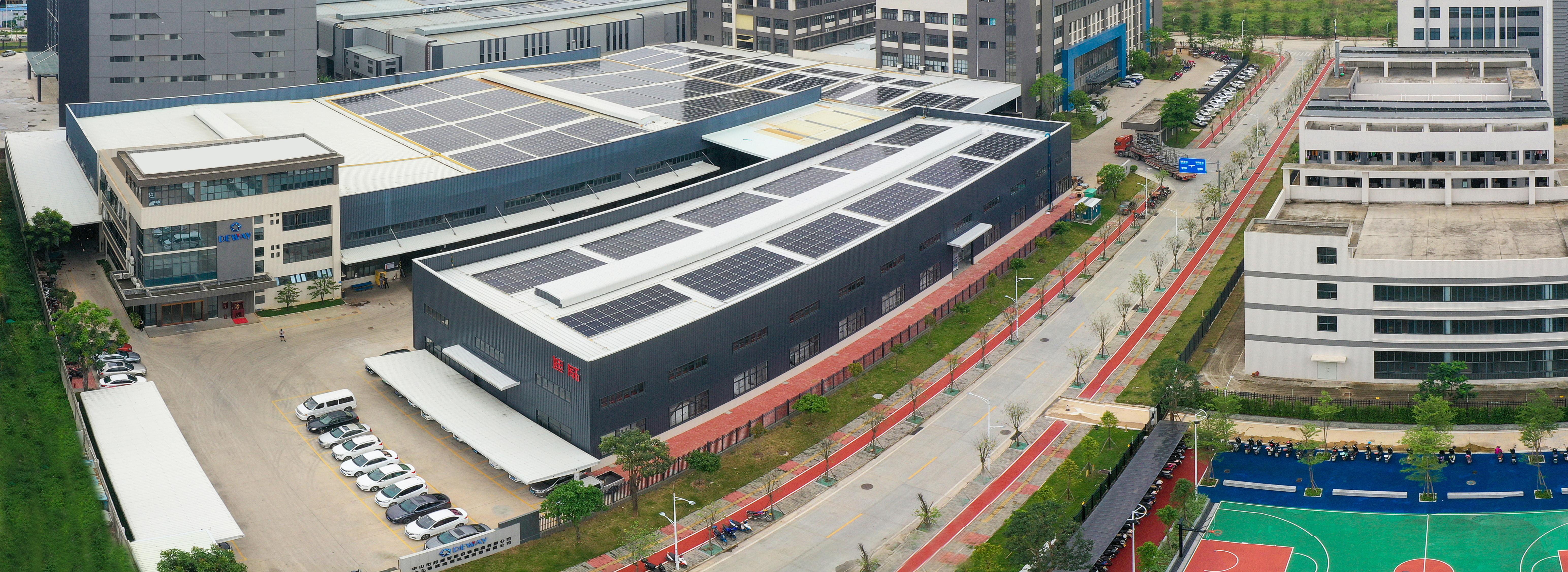

Major companies such as Bottero, Glaston, and LiSEC compete on innovation and customization. Among them, Deway Intelligent Equipment Manufacturing Co., Ltd. stands out as a high-tech enterprise specializing in R&D and sales of intelligent equipment for high-end glass processing. The company’s product portfolio includes glass edge polishing machines, glass bevel machines, double edger machines, glass chamfering machines, and glass washing machines. Renowned for technological sophistication and reliability, Deway Intelligent remains committed to innovation-driven development, delivering integrated solutions that strengthen global competitiveness.

Additionally, research initiatives like the DigiGlas project in Germany are leveraging AI and simulation to advance glass molding processes, cutting material waste by up to 90% and reducing CO₂ emissions. Such efforts underscore the industry’s shift toward sustainable, digitalized production.

Conclusion

The glass machinery market is transitioning toward intelligent, eco-friendly, and cost-effective solutions. With strong momentum from APAC’s infrastructure boom and Europe’s sustainability agenda, manufacturers who prioritize R&D in automation—such as Deway Intelligent—are well-positioned to lead the next phase of industry growth.